GST on Smartphones and Electronics Slashed, Making Them More Affordable

In a positive development, the Union Finance Ministry in India has announced a reduction in GST (Goods and Services Tax) on smartphones and various electronic goods. This revised taxation is expected to bring down prices and increase affordability. Let’s delve into the details and gain a clearer understanding.

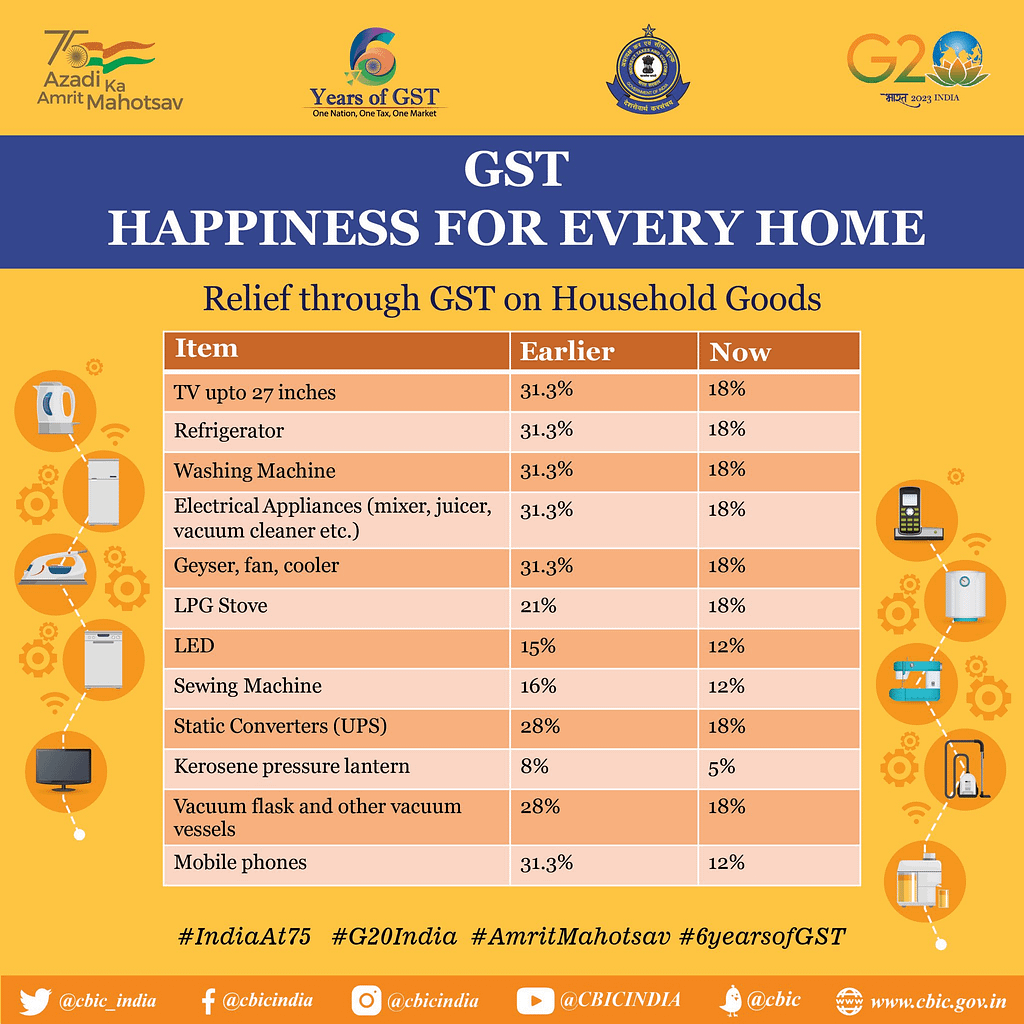

GST on Smartphones and More Reduced: To commemorate six years of GST implementation, the Finance Ministry has significantly decreased the GST on smartphones, televisions, and other consumer electronics. Mobile phones will now be taxed at 12%, leading to potential price reductions and offering good news to consumers.

Televisions (up to 27 inches), refrigerators, and washing machines will attract an 18% GST. Additionally, home appliances like mixers, juicers, vacuum cleaners, and geysers have also witnessed a reduction in tax rates.

However, the recent reform may create confusion due to the comparison between previous and current tax rates. To clarify, the reduced GST on phones is not a surprising or drastic change. Initially, when GST was introduced in 2017, a 12% tax rate was set for phones. It was then increased to 18% in 2020, and now it has been brought back to 12% as announced in the Union Budget 2023. This revised rate will apply to future purchases.

It’s important to note that the extremely high tax rate of 31.3% mentioned represents the tax levied before the implementation of GST. Therefore, while a reduction has been declared, it is not as substantial as it may appear.

Going forward, purchasing a smartphone will entail lower taxes, resulting in potential savings for consumers. However, these changes are likely to come into effect for upcoming phones in 2023 or 2024.

Furthermore, this reduction in GST could potentially impact the pricing of the upcoming iPhone 15 series. It offers hope that these devices will be comparatively more affordable in India, where they have historically been more expensive than in the US and other global markets due to currency exchange rates.

Nevertheless, the direct impact of this significant change is yet to be determined. Will we witness visible price cuts across smartphone brands? Are there any hidden costs? These questions remain unanswered, and we await further details. Feel free to share your thoughts on this tax reform and whether it brings relief in the comments section below.