Building an Emergency Fund: Your Comprehensive Guide to Financial Security

An emergency fund is an integral part of a robust financial strategy, providing both peace of mind and stability during uncertain times. In this comprehensive guide, we explore the significance of having an emergency fund and outline effective strategies to build and manage it for a secure future.

Also read: What to Consider Before Building an Emergency Fund

The Importance of an Emergency Fund

- An emergency fund acts as a financial safety net, shielding you from unexpected expenses and unforeseen situations.

- Reasons why an emergency fund is essential: peace of mind, debt avoidance, managing emergencies, coping with unemployment, and enhancing financial resilience.

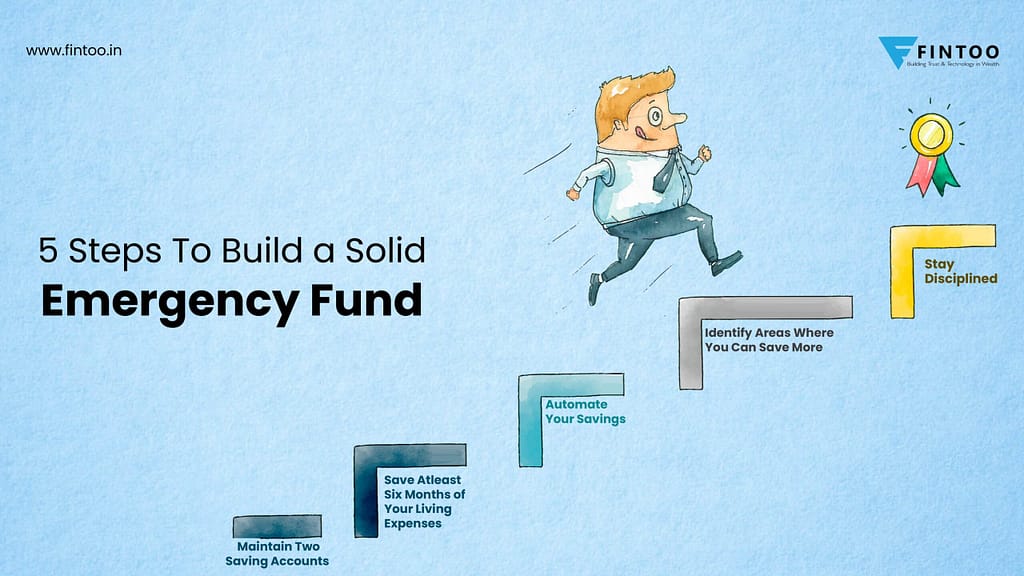

Setting Your Emergency Fund Goals: Steps to Achieve Financial Security

- Determine Monthly Expenses:

- Calculate all essential expenses, including housing, utilities, food, transport, and insurance, to understand your financial needs.

- Set a Savings Goal:

- Define a target amount based on your monthly expenses, creating a foundation for your emergency fund.

- Budget and Reduce Non-Essential Spending:

- Craft a budget focusing on emergency fund savings, identify areas for expenditure reduction, and prioritize savings.

- Explore Suitable Investment Options:

- Consider low-risk investments like liquid funds or arbitrage funds to grow your emergency fund while maintaining liquidity.

- Automate Savings:

- Set up automatic transfers from your checking account to your emergency fund to ensure consistent savings without manual intervention.

- Regular Reassessment:

- Periodically review your financial situation and adjust your emergency fund goals if needed, considering changes in expenses or income.

Choosing the Right Savings Account: Maximizing Emergency Fund Returns

- Prioritize High Yield Savings Accounts for better interest rates, ensuring safety, convenience, and growth of your emergency fund.

- Consider factors like fees, minimum deposits, and customer service when selecting a savings account.

Prioritizing Expenses: Strategies for Building Your Emergency Fund

- Create a budget, tracking all expenses to identify areas for reduction.

- Prioritize essential expenses such as food and shelter, allocating surplus funds to non-essential areas.

- Focus on debt reduction, starting with high-interest debts, to free up more money for your emergency fund.

- Assess subscriptions and discretionary spending, eliminating unnecessary expenses and redirecting those funds to savings.

Maximizing Your Income: Strategies for Financial Growth

- Early Investing:

- Initiate investments early, starting small and increasing gradually with rising income levels.

- Diversify Investments:

- Spread investments across assets like stocks, bonds, mutual funds, and real estate to mitigate risks.

- Set Realistic Goals:

- Establish achievable investment objectives, emphasizing long-term gains over quick riches.

- Consider Low-Cost Index Funds:

- Opt for low-cost index funds, balancing returns and fees, for steady, long-term growth.

- Reinvest Dividends:

- Reinvest dividends to purchase additional shares, accelerating the growth of your investments over time.

Investing Your Emergency Fund: Balancing Risk and Liquidity

- Determine your risk tolerance, opting for low-risk, diversified investments with high liquidity for your emergency fund.

- Regularly reassess your investment strategy, aligning it with your financial situation and goals.

Managing Your Emergency Fund: Tips for Safety and Accessibility

- Goal Determination:

- Calculate your emergency fund needs based on living expenses for a set period, adhering to experts’ recommendations.

- Choosing the Right Account:

- Opt for High Yield Savings Accounts, focusing on interest rates, fees, minimum deposits, and customer service.

- Automation and Separation:

- Automate transfers to your emergency fund, keeping it separate from daily expenses to prevent unnecessary spending.

- Regular Re-Evaluation:

- Periodically review your emergency fund goals, making adjustments based on changing needs, ensuring preparedness for unexpected events.

Also read: Top SIP Mutual Funds in India: Your Ultimate Guide to Smart Investments

Conclusion:

- Building and managing an emergency fund requires careful planning, budgeting, and wise investment choices.

- Regular reassessment and adaptation to changing circumstances are key to maintaining a robust financial safety net.

- Prioritizing savings and making informed investment decisions pave the way for a secure and stable future.