The Ultimate Guide to Building Your Dividend Growth Portfolio: Top Dividend Stocks and Strategies for Success in 2023

Industrial growth of business chart

Discover the Art of Dividend Investing: A Comprehensive Guide to Top Dividend Stocks in India

Dividends are more than just passive income; they are the gateway to financial freedom. Renowned investors like Warren Buffet and Benjamin Graham have long cherished dividend stocks for their potential to generate lucrative returns. In this guide, we’ll delve into the world of dividend investing, unveiling the top dividend-paying stocks in India for 2022. Learn how to build your dividend growth portfolio and embark on a journey towards financial independence.

Kindly visit cube wealth to know more!

Understanding Dividend Investing

Explore the fundamentals of dividend growth portfolios, an investment strategy favored by the financial giants. Learn how dividends offer a unique blend of passive income and wealth accumulation, making them a cornerstone of a successful investment portfolio.

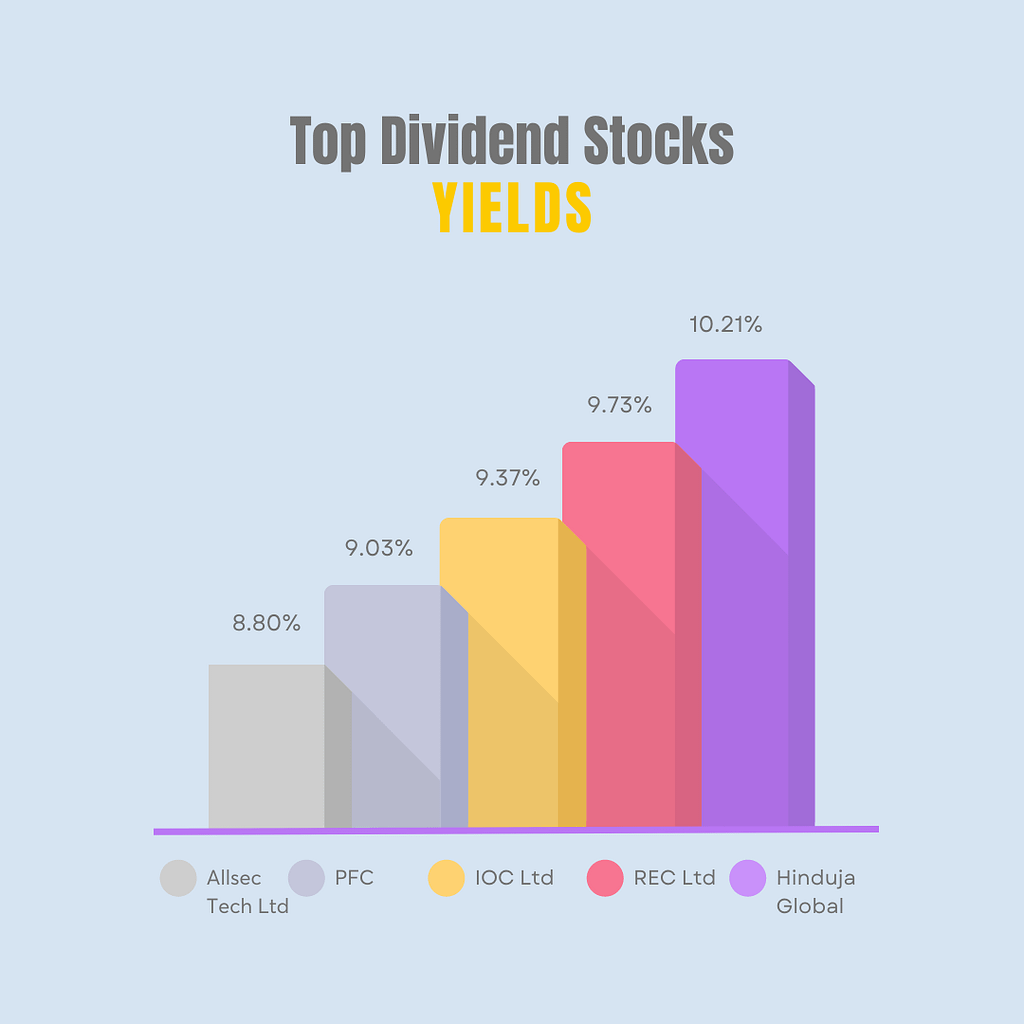

Top Dividend Stocks in India

Dive into the Cream of the Crop: Our Curated List of Best Dividend-Paying Stocks

Allsec Technologies (Stock Ticker: ALLSEC)

- Dividend Yield: 8.80%

- Track Record: Paying dividends since 2006.

- Financial Snapshot: Q3 2022 net profit surged by 48.37%.

Allsec Technologies Stock Details

| Company Name | Allsec Technologies Ltd |

| Stock Ticker | ALLSEC |

| Stock Price | ₹512.40 |

| Market Cap | ₹777 Crores |

| Dividend Yield | 8.80% |

Power Finance Corporation (Stock Ticker: PFC)

- Dividend Yield: 9.03%

- Track Record: Paying dividends since 2007.

- Financial Snapshot: Q3 FY2022 net profit rose by 24%.

Power Finance Corporation Stock Details

| Company Name | Power Finance Corporation Ltd |

| Stock Ticker | PFC |

| Stock Price | ₹119.00 |

| Market Cap | ₹31,416 Crores |

| Dividend Yield | 9.03% |

Indian Oil Corporation Ltd (Stock Ticker: IOC)

- Dividend Yield: 9.37%

- Track Record: Paying dividends since 2001.

- Financial Snapshot: Q3 FY2022 net profit reached ₹5,861 crores.

Indian Oil Corporation Stock Details

| Company Name | Indian Oil Corporation Ltd |

| Stock Ticker | IOC |

| Stock Price | ₹128.20 |

| Market Cap | ₹120,595 Crores |

| Dividend Yield | 9.37% |

REC Ltd (Stock Ticker: RECLTD)

- Dividend Yield: 9.73%

- Track Record: Paying dividends since 2008.

- Financial Snapshot: Q3 FY2022 net profit stood at ₹2,773.44 crores.

REC Stock Details

| Company Name | REC Ltd |

| Stock Ticker | RECLTD |

| Stock Price | ₹130.75 |

| Market Cap | ₹25,831 Crores |

| Dividend Yield | 9.73% |

Hinduja Global (Stock Ticker: HGS)

- Dividend Yield: 10.21%

- Track Record: Paying dividends since 2007.

- Financial Snapshot: Net profit rose to ₹163.76 crores in December 2021.

Hinduja Global Stock Details

| Company Name | Hinduja Global |

| Stock Ticker | HGS |

| Stock Price | ₹1,099.00 |

| Market Cap | ₹4,561 Crores |

| Dividend Yield | 10.21% |

Image Credit: bankoncube

Strategies for Building Your Dividend Growth Portfolio

Learn the art of cherry-picking dividend stocks and constructing a robust portfolio. Understand the importance of diversification, risk management, and long-term vision in maximizing your dividends.

Also read: The Ultimate Guide to Short-Term Investments in 2023: Top Options & How to Invest

Frequently Asked Questions:

Q1: What is a dividend growth portfolio, and why is it essential for investors?

A dividend growth portfolio comprises stocks that pay dividends and have the potential for significant returns. It provides a blend of passive income and wealth accumulation, crucial for achieving financial freedom.

Q2: Can dividends be a reliable source of income for lifelong sustenance?

Yes, dividends can serve as a consistent income stream if strategically planned. By building a diversified portfolio of reliable dividend-paying stocks, investors can potentially rely on dividends for lifelong financial support.

Q3: How can I identify the best dividend-paying stocks for my portfolio?

Focus on companies with a strong track record of dividend payments, stable financial growth, and a history of consistent dividends. Conduct in-depth research, analyze financial reports, and consider expert recommendations to identify top dividend stocks.

Q4: Is dividend investing suitable for long-term financial goals, such as retirement planning? Absolutely. Dividend investing is ideal for long-term financial goals. Reinvesting dividends over the years can compound wealth significantly, making it a robust strategy for retirement planning and achieving long-term financial security.

Conclusion: Embark on Your Journey to Financial Freedom

Armed with the knowledge of top dividend stocks and expert strategies, you’re ready to build your dividend growth portfolio. Begin your path towards financial freedom, passive income, and a secure financial future.