CAGR Calculator

CAGR

CAGR (Compound Annual Growth Rate) measures the mean annual growth rate of an investment over a specified time period.

The Compound Annual Growth Rate (CAGR) measures the mean annual growth rate of an investment over a specified period, assuming the profits are reinvested at the end of each period. It provides a smoothed annual rate that eliminates the effects of volatility, offering a clearer picture of an investment's performance over time.

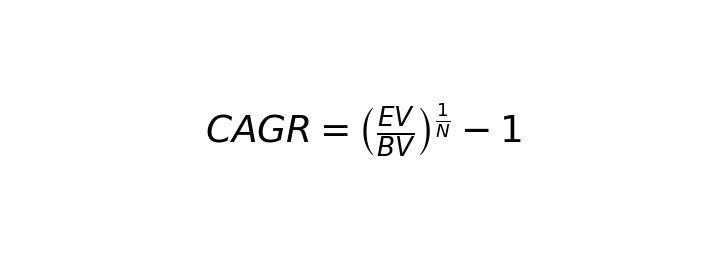

CAGR Formula:

Where:

- Beginning Value: The initial value of the investment.

- Ending Value: The value of the investment at the end of the period.

- Number of Years: The total duration of the investment in years.

Example Calculation:

Suppose you invested ₹10,000 in a mutual fund, and after 5 years, the investment's value grew to ₹15,000.

Applying the CAGR formula:

CAGR=(15,00010,000)15−1\text{CAGR} = \left( \frac{15,000}{10,000} \right)^{\frac{1}{5}} - 1CAGR=(10,00015,000)51−1

CAGR=(1.5)0.2−1\text{CAGR} = (1.5)^{0.2} - 1CAGR=(1.5)0.2−1

CAGR=1.08447−1\text{CAGR} = 1.08447 - 1CAGR=1.08447−1

CAGR=0.08447 or 8.447%\text{CAGR} = 0.08447 \text{ or } 8.447\%CAGR=0.08447 or 8.447%

Therefore, the investment experienced an average annual growth rate of approximately 8.447% over the 5-year period.

Benefits of Using a CAGR Calculator:

- Performance Evaluation: CAGR provides a straightforward metric to assess the annual growth rate of an investment, making it easier to compare different investments.

- Goal Setting: Investors can set realistic financial goals by understanding the growth rate required to achieve a target investment value within a specific timeframe.

- Benchmarking: CAGR allows investors to benchmark their investment's performance against market indices or other investment opportunities.

For a convenient way to calculate CAGR, you can use online tools like the Eleventh Unicorn CAGR Calculator, which simplifies the computation process.

Note: CAGR assumes a steady growth rate over the period, which may not reflect the actual year-to-year performance of an investment. It's essential to consider other factors and metrics when evaluating investments.