Understanding GST

Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services in India. Introduced on July 1, 2017, GST replaced most of the previous indirect taxes to create a single, unified tax system. It follows a multi-stage, destination-based taxation model, ensuring that tax is collected at every stage of value addition.

GST rates are categorized into different slabs: 0%, 5%, 12%, 18%, and 28%. However, some goods like petroleum products, alcoholic beverages, and electricity are taxed separately by state governments, outside the GST system.

Types of GST in India

GST is divided into four categories, depending on the nature of the transaction:

- Central Goods and Services Tax (CGST) – Levied by the Central Government on intra-state supplies.

- State Goods and Services Tax (SGST) – Collected by the State Government on intra-state transactions.

- Union Territory Goods and Services Tax (UTGST) – Applicable in Union Territories instead of SGST.

- Integrated Goods and Services Tax (IGST) – Charged on inter-state transactions and imports, collected by the Central Government.

When a transaction occurs within the same state, both CGST and SGST are levied equally. For inter-state transactions, IGST is applied.

What is a GST Calculator?

A GST Calculator is a fast and accurate tool that helps businesses, manufacturers, and consumers calculate their GST liability in real-time. It simplifies tax calculations by computing GST amounts, net price, and final payable amounts.

Using a GST calculator, businesses can:

- Determine GST-exclusive and GST-inclusive prices.

- Accurately split CGST, SGST, and IGST.

- Minimize errors and save time in tax calculations.

- Ensure compliance with GST rules and regulations.

How to Calculate GST?

GST calculations vary based on whether the price includes or excludes GST.

GST Calculation Formula

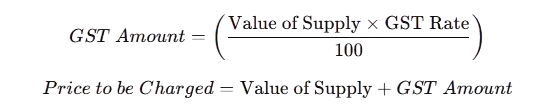

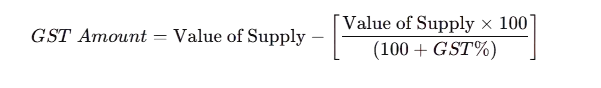

- For GST-exclusive price:

- For GST-inclusive price:

Example of GST Calculation

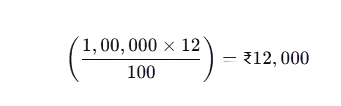

Case 1: GST Exclusive Price Calculation

- Invoice Value: ₹1,00,000

- GST Rate: 12%

- GST Amount:

- Final Price: ₹1,12,000

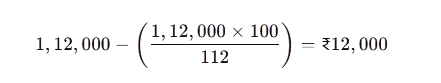

Case 2: GST Inclusive Price Calculation

- Final Price (GST included): ₹1,12,000

- GST Rate: 12%

- GST Amount:

- Base Price: ₹1,00,000

How GST Impacts Manufacturers, Wholesalers, and Retailers

GST Calculation for Manufacturers

| Particulars | Rate (%) | Pre-GST Amount | Under GST |

|---|---|---|---|

| Cost of Product | – | ₹2,00,000 | ₹2,00,000 |

| Profit Margin (10%) | 10% | ₹20,000 | ₹20,000 |

| Excise Duty (12.5%) | 12.5% | ₹27,500 | Nil |

| Total | – | ₹2,47,500 | ₹2,20,000 |

| VAT (12.5%) | 12.5% | ₹30,938 | Nil |

| CGST (6%) | 6% | Nil | ₹13,200 |

| SGST (6%) | 6% | Nil | ₹13,200 |

| Final Price to Wholesaler | – | ₹2,78,438 | ₹2,46,400 |

GST Calculation for Wholesalers & Retailers

| Particulars | Rate (%) | Pre-GST Amount | Under GST |

|---|---|---|---|

| Cost of Product | – | ₹2,78,438 | ₹2,46,400 |

| Profit Margin (10%) | 10% | ₹27,844 | ₹24,640 |

| Total | – | ₹3,06,282 | ₹2,71,040 |

| VAT (12.5%) | 12.5% | ₹7,347 | Nil |

| CGST (6%) | 6% | Nil | ₹3,062 |

| SGST (6%) | 6% | Nil | ₹3,062 |

| Final Invoice to Consumer | – | ₹3,13,629 | ₹2,77,164 |

How to Use the GST Calculator?

To compute GST using the Eleventh Unicorn GST Calculator, follow these steps:

- Enter the net price of the product or service.

- Select the applicable GST rate (5%, 12%, 18%, or 28%).

- Click on ‘Calculate’ to get the GST amount.

- The calculator will display:

- GST Amount

- Final Price (including GST)

- Breakdown of CGST, SGST, or IGST

Components of a GST Calculator

A GST Calculator consists of the following components:

- GST Rate Selection – Choose the correct tax slab for the goods or services.

- Value of Supply – The net price before GST is applied.

- GST Calculation – Computes GST based on the selected rate and value.

- Final Output – Displays tax breakdown and final amount payable.

Advantages of Using the Eleventh Unicorn GST Calculator

- Accurate Tax Computation – Eliminates manual errors in GST calculations.

- Fast and Efficient – Get results instantly without complex formulas.

- Breakdown of GST Components – Separates CGST, SGST, and IGST accurately.

- Ensures Compliance – Helps businesses adhere to GST laws.

- Saves Time – Reduces the time spent on tax calculations and invoicing.

Start Using the GST Calculator Today

Understanding and calculating GST correctly is crucial for businesses and individuals alike. The Eleventh Unicorn GST Calculator simplifies tax calculations, ensuring that you always stay compliant and make informed financial decisions.

Use the Eleventh Unicorn GST Calculator now to compute GST instantly and accurately.