Lumpsum Calculator

Initial Investment: ₹0

Expected Returns: ₹0

Future Value: ₹0

What Is Lumpsum Investment?

A lumpsum investment is when you invest a large amount of money in one go, rather than spreading it out over time like an SIP (Systematic Investment Plan). This one-time investment benefits from compounding interest, helping you maximize returns in a mutual fund and achieve your financial goals.

Why Use a Lumpsum Investment Calculator?

Before making any investment, it is important to estimate its future value. A Lumpsum Investment Calculator helps you:

- Get Instant Estimations – Simply enter the amount, duration, and expected return rate.

- Improve Financial Planning – Align your investment with long-term goals like buying a house, funding education, or retirement planning.

- Compare Different Scenarios – Adjust investment values, duration, or return rates to explore different outcomes.

What Is a Lumpsum Calculator & How Does It Work?

A Lumpsum Return Calculator is an online tool that helps you predict the future value of your investment. It considers:

- Initial Investment (the amount you invest at once)

- Expected Return Rate (annual percentage growth)

- Investment Duration (number of years)

With these inputs, the calculator estimates the maturity amount, helping you plan your finances efficiently.

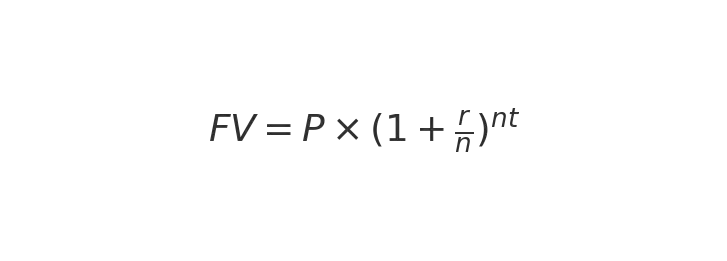

Formula to Calculate Lumpsum Investment Returns

The compound interest formula used for lumpsum investment calculation is:

Where:

- P = Initial Lumpsum Investment

- r = Expected Annual Rate of Return (in decimal form)

- n = Number of times returns are compounded annually

- t = Investment Duration (in years)

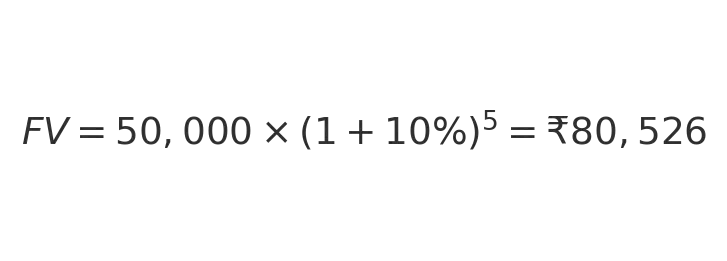

Example Calculation

Suppose you invest ₹50,000 in a mutual fund for 5 years at an expected annual return of 10% (compounded annually).

Using the formula:

So, in 5 years, your investment will grow to ₹80,526, earning you ₹30,526 in returns.

How to Use the Lumpsum Investment Calculator

Using the Lumpsum Calculator is simple:

- Enter the initial investment amount (₹).

- Enter the investment duration (number of years).

- Enter the expected return rate (%).

- Click Calculate to see:

- Future Value of Your Investment

- Total Returns Earned

- Breakdown of Investment & Growth

This helps you decide if your investment aligns with your goals or if adjustments are needed.

Benefits of Using a Lumpsum Calculator

The mutual fund lumpsum calculator is a valuable tool for investors. It offers:

- Instant & Accurate Estimates – Get results in seconds without manual calculations.

- Better Financial Planning – Know how much to invest to achieve financial goals.

- Scenario Comparison – Adjust inputs to test different investment strategies.

- Time & Effort Saving – Eliminates the need for spreadsheets or manual math.

- Avoid Over-Investing or Under-Investing – Get clarity on the best investment amount.

Lumpsum vs SIP – Which One is Better?

| Factor | Lumpsum Investment | SIP (Systematic Investment Plan) |

|---|---|---|

| Investment Type | One-time investment | Recurring investments (monthly/quarterly) |

| Market Risk | Higher (invests all at once) | Lower (spreads investment over time) |

| Compounding Benefits | Strong long-term growth | Gradual compounding over time |

| Discipline Needed | No regular commitment | Requires consistent investing |

| Best For | Long-term wealth creation | Building wealth over time, managing risk |

Choosing the Right Investment Option

- Lumpsum Investment is ideal for those with a large investable amount, aiming for higher long-term returns.

- SIP is better suited for investors preferring a low-risk, steady investment approach that reduces market fluctuations. Use SIP Calculator now.

Both strategies can be combined for better portfolio diversification.

Why Use Our Lumpsum Investment Calculator?

Our Lumpsum Calculator is:

- Fast & User-Friendly – Simple inputs, quick results.

- Highly Accurate – Uses the correct compound interest formula.

- 100% Free & Online – No sign-ups or hidden charges.

- SEO-Optimized – Designed to help investors find the best mutual fund strategies.

- Mobile-Friendly – Works smoothly on all devices.

Visit Eleventh Unicorn for latest Updates.