Attempted PhonePe Scam: A Tale of Quick Thinking and Scam Awareness

It was just the day before yesterday, August, 2023, when an unsettling phone call reached my mother’s Samsung smartphone. Little did we know, this call would be an attempt to perpetrate a scam that has victimized many. However, we were prepared and aware, ready to tackle the situation head-on.

Let me give you some context. My mother owns two mobile phones. One is a Nokia keypad phone linked to a bank account and a BSNL SIM, devoid of any UPI functionality. The other is a Samsung smartphone, connected to her Paytm Payments Bank (solely for online transactions) and an Airtel SIM, equipped with UPI capabilities.

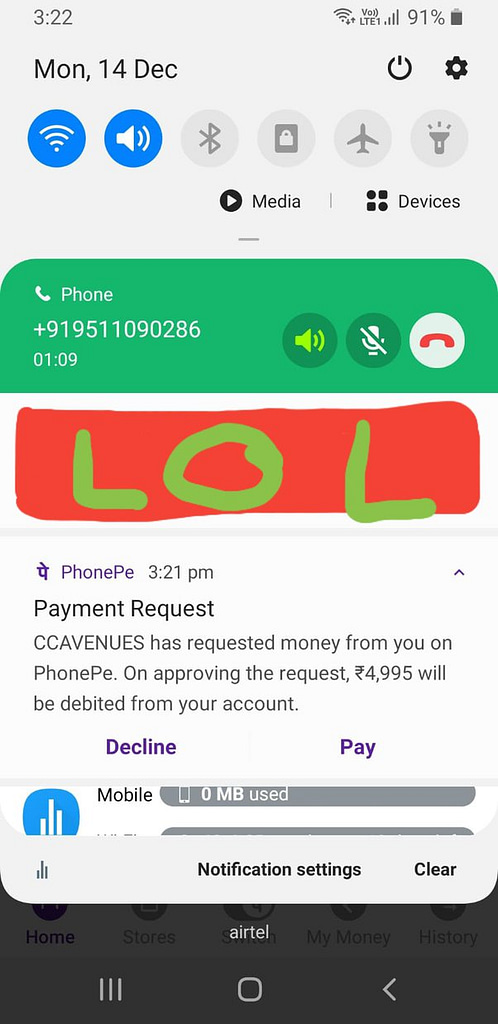

The attempted scam started with a call to my mom’s Samsung phone. The caller claimed to be from PhonePe and informed my mother that she had coupons worth a substantial amount, ₹4,995, which could be easily transferred to her bank account. With her guard up, my mom asked the caller to hang up and call back in two minutes. Sensing a potential scam, she handed me the phone, entrusting me to deal with the situation.

Upon calling back, the scammer tried to convince me of the same story, emphasizing that he wanted me to transfer the coupon amount to a bank account. Curiously, he even provided a notification indicating a request for ₹4,995. I was well aware of this scam and decided to have a little fun with it. I feigned ignorance and told him that I had received a request to pay the specified amount. To my amusement, he clarified that the request was not about receiving money but rather transferring money from my PhonePe account to a bank account. Suppressing a chuckle, I played along.

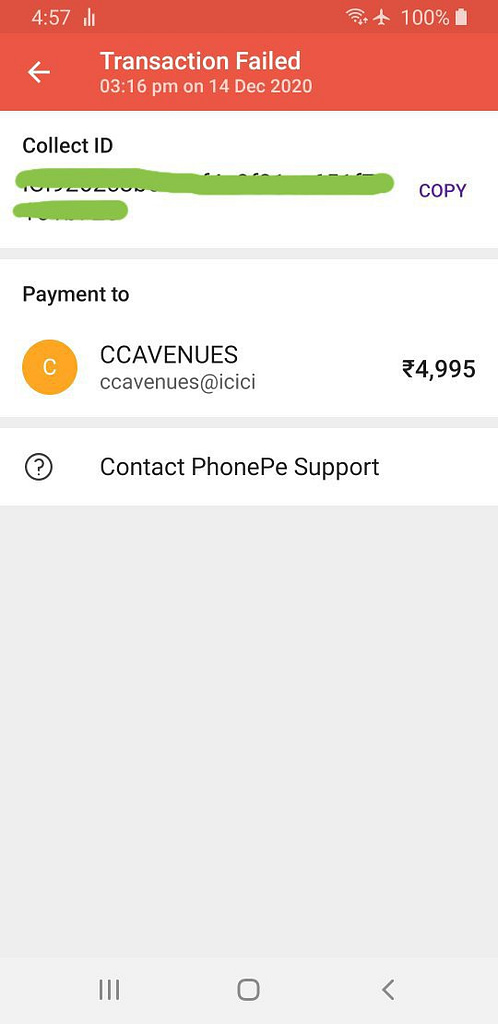

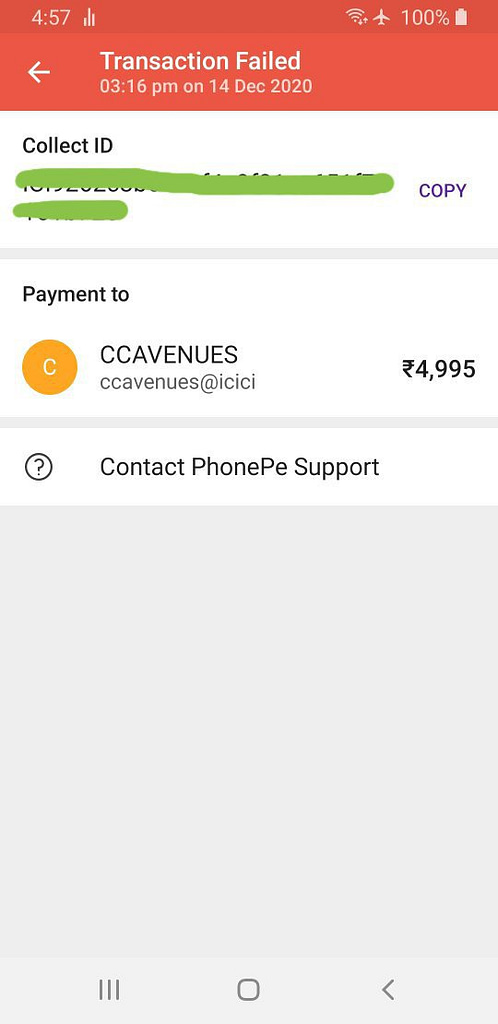

Knowing that my mom’s Paytm account had a balance of zero, I proceeded with the charade. I clicked on the “Pay” option, which prompted me for the UPI PIN. I entered the PIN, half-expecting it to fail due to insufficient funds. As anticipated, the transaction was declined due to a lack of balance.

Seizing the opportunity, the scammer inquired about the number of bank accounts linked to the phone. I responded with one. This opened a new avenue for the scammer’s plot. He claimed that this was the reason why the first transaction failed, indicating that he needed to conduct two separate transactions: one for ₹2,000 and another for ₹3,000.

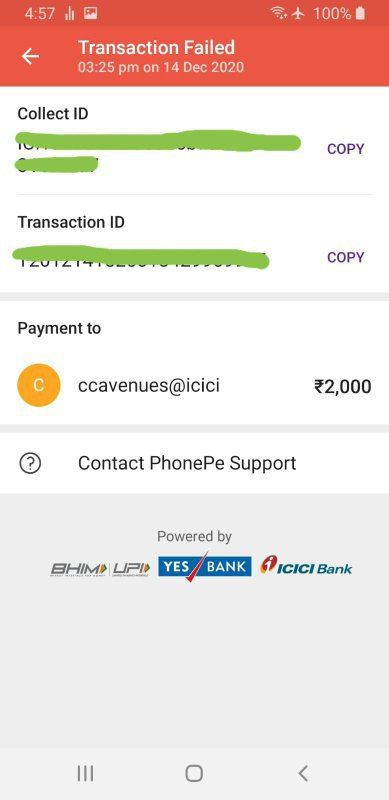

Undeterred, I followed his lead as he sent a request for ₹2,000. Again, I pretended to go along with the scam, letting the transaction fail due to insufficient funds. When I conveyed this outcome, the scammer abruptly ended the call.

My family has encountered these types of scams three times since March 2023. It’s clear that these scammers are persistent and cunning, trying various tactics to catch their prey off-guard. Their audacity is fueled by the anonymity they maintain.

It’s important to note that we have consciously chosen not to conceal the scammer’s number. This decision stems from the belief that exposing the identities of these malicious actors can help discourage them from continuing their fraudulent activities. By sharing our experiences and shedding light on the tactics they employ, we aim to arm others with the knowledge to combat such scams effectively.

Scams like these are becoming increasingly sophisticated and prevalent, posing a significant threat to individuals’ financial security. It’s crucial to stay informed, exercise caution, and report any suspicious activity promptly to thwart these nefarious efforts.

Remember, being vigilant is your best defense against falling victim to scams. Stay educated, stay safe, and stay one step ahead of the scammers.